THOUGHT LEADERSHIP

Can commercial solar and storage reduce risk in an evolving electricity grid?

How can distribution network service providers best take advantage of the emerging opportunities presented by commercial solar and storage systems to reduce risk in an evolving electricity grid?

Commercial solar generation (large solar arrays in places such as factories, universities, airports, etc) and other types of mid-scale embedded generation and storage are already adding value to the electricity network, despite emerging in a relatively ad-hoc way in the grid.

For distribution network service providers (DNSPs), forms of embedded renewable generation and storage have typically caused some disruption of standard business models.

However, by better understanding the drivers for commercial solar and storage, and their opportunities for network benefits, DNSPs can take some level of control, reduce risk and build network value.

Opportunities for commercial solar in existing networks

Commercial solar and storage are primarily driven by non-cost-reflective retail tariffs. This means that, despite offering some benefits, commercial solar and storage are unlikely to be delivering their full potential benefits, such as reducing the costs of grid development, reducing peak demand, and increasing grid reliability, ultimately lowering power bills for consumers. In the process, they can also create additional workload for DNSPs, often requiring grid augmentations, development of new materials and procedures, and processing connection applications.

Rather than seeing this as a headache at the fringe of their core business, DNSPs need to be more active in using and incentivising these technologies in places where they add value, such as where they can reduce the costs of building and operating the network. DNSPs need to embrace the fact that these technologies will become a dominant factor in their business over the next 10 to 15 years (if not sooner) and plan accordingly.

This means that DNSPs will need to gain experience and understanding in:

- the technical capabilities of the new technology, including the rapid advances in their ability to provide grid support

- the statistical nature of renewable generation, and why it has already contributed to reducing peak load (and how this relates to type of generation, geographical location, and rates of uptake)

- the business model for proponents, how sensitive this is, and how it can be strongly influenced by subtle incentives to install in areas that are of benefit to the DNSP

- operation of new technologies, in particular battery storage, to understand their control capabilities and limitations, and the economics of their operation

- how best to measure reliability in renewable generation systems and storage, and

- the possibilities offered by forecasting.

Recent Australian Energy Market Commission rule changes provide a new framework under the Australian Energy Regulator to support these kinds of development activities. Under this framework, the Demand Management Incentive Scheme (DMIS) and Demand Management Innovation Allowance (DMIA) will provide significant support for DNSPs to undertake activities that are likely to benefit both electricity customers and DNSPs in the long run, by supporting exploration of new types of non-network solutions.

However, the points listed above are really just the beginning, and DNSPs need to be looking further ahead to new models of supply. At the moment, the price point of renewables and storage mean that many straight-out non-network solutions aren’t financially viable, but of course these technologies are still going in, in increasing numbers, so understanding the broader value chain is essential for leveraging these technologies.

Opportunities for DNSPs from commercial solar and storage in network extension and in-fill

DNSPs need to consider how to incentivise or signal the need for embedded generation and storage in particular areas of their network, and need a plan for managing short-term shortfalls or long-term surplus.

Several DNSPs appear to have network support applications for fringe of grid well in hand through trials (including under the DMIA and DMIS) and are rapidly gaining experience with storage technology. However, network applications in areas with nodal constraints (e.g. at substations), new developments, and incremental benefits have far wider application and implications.

New developments offer two ‘network support’ opportunities, both of which could save money for the developer: the capacity of the connection is reduced (resulting in lower rated transformers, switchgear, etc.), and there is less chance of ‘upstream’ upgrades being required in the network to support the additional load. Cost savings from these opportunities would be weighed against the cost of the battery and solar, taking into account the value of other revenue streams (mainly sale and arbitrage of energy).

As an example, new housing and industrial developments are increasingly looking to minimise their connection capacity by adding commercial solar and storage. In doing so, they are taking on many of the above factors, and inherently making a choice about the value of customer reliability. And this choice will be different for different customers (e.g. a data centre that installs an uninterruptible power supply is a very different customer from an eco-housing development with battery and solar on every house).

Significant opportunities exist for DNSPs to use commercial solar and storage to allow far more flexibility in ‘selecting’ the level of reliability delivered to the development. This will, of course, take into account the value of customer reliability (VCR), but can do so in a far more detailed and localised way than would be the case using VCR based at the level of the State. By tying into the values of residents buying into a ‘green’ suburb, it may be possible to establish a lower VCR (i.e. they may accept occasional additional faults associated with the smaller grid connection and probabilistic nature of the solar and storage capacity).

Ensuring DNSPs benefit from commercial solar and storage

The strategic DNSP needs to fully assess the risks and impacts of new mid-scale embedded generation or storage connections and keep a weather eye as solutions emerge to enable future network support. This requires a range of detailed information.

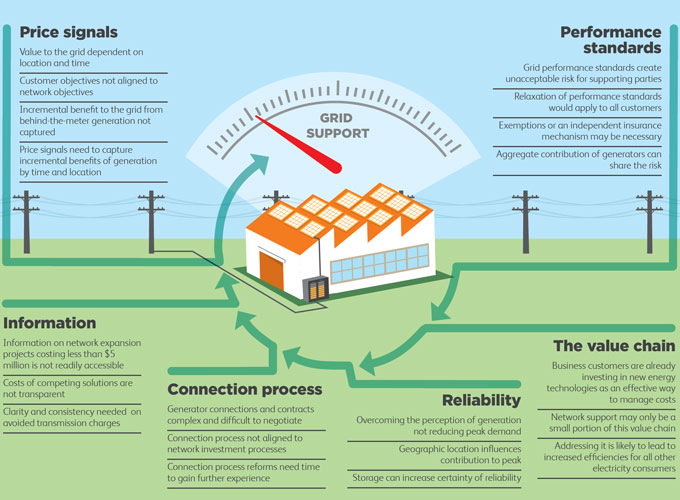

Entura’s detailed analysis of the commercial, technical and regulatory aspects of commercial solar and storage identifies the key areas that still need to be addressed so that DNSPs, proponents and consumers can fully harness the potential benefits these technologies can offer the grid.

Australia’s Clean Energy Council engaged Entura to conduct this extensive study because we understand the issues facing DNSPs, the regulatory constraints, the technology and its applications, and the multiple revenue streams that make up the business case for its proponents. Our engagement with a wide range of stakeholders and analysis of common and emerging generation technologies and deployment configurations is documented in the Clean Energy Council report Grid Support: Revealing Mid-scale Generation and Storage Potential.

To discuss how Entura can support you to best take advantage of the benefits of mid-scale embedded generation and storage, contact Chris Blanksby on +61 408 536 625, Patrick Pease, or Silke Schwartz on +61 407 886 872.

About the author

Dr Chris Blanksby is a Senior Renewable Energy Engineer at Entura, and Entura’s lead solar energy specialist. In addition to leading the above-mentioned report for the Clean Energy Council, Chris previously led the work on demand-side-management opportunities for the Clean Energy Council. Chris has undertaken and published research on the solar resource in Australia, and has led several due diligence and owner’s engineer projects for wind, solar and microgrid projects in Australia, the Pacific and Asia. Chris is currently leading Entura’s owner’s engineer team assisting the Government of Cook Islands to implement six solar PV microgrid projects, and build capacity towards their 100% renewable target.

MORE THOUGHT LEADERSHIP ARTICLES

8 April, 2016