Identifying Australia’s best sites for pumped hydro development

There are many thousands of potential sites for pumped hydro energy storage developments across Australia, but how can a developer filter these down to the best few?

As Australia’s energy market progressively transitions from ageing thermal generation to increasing amounts of wind and solar, there are ample chances to explore and develop the energy storage solutions needed to mitigate the challenges that may come with the introduction of more renewables into the energy market.

With increased intermittent renewables, we will require more storage to smooth out the variability of weather-dependent generation so that energy is available on demand. As well, we will need storage that provides the inertia, voltage and frequency control required for a stable, reliable grid.

The key to successfully embracing these energy storage opportunities will lie in identifying the right mix of technology, capacity and site; however, pinpointing potentially viable projects is complex. A theoretical or academic approach won’t be enough to ensure a future project’s success in the real world.

Pumped hydro is a highly efficient, longer-duration solution with a proven track record, and its future is bright as Australia seeks cost-effective, reliable options to make intermittent renewables ‘dispatchable’.

There are thousands of potential pumped hydro sites across Australia. This means that developers and investors need smart methods of filtering to reduce the many possibilities to just a few ideal sites.

A pumped hydro project is a major capital investment. Getting site selection right is the foundation for success, as it will determine the likelihood of achieving a design that is both technically and commercially feasible with the right mix of capacity and costs.

Pumped Hydro Atlas of Australia offers a head start in site selection

Entura has produced a practical atlas of pumped hydro energy storage opportunities to support development of dispatchable renewable energy generation across Australia’s National Electricity Market (NEM).

Through an exhaustive process, the atlas filtered many thousands of potential sites down to the best 20 around Australia. It is already being used by leading renewable energy company Hydro Tasmania to shortlist potential pumped hydro sites for the ‘Battery of the Nation’ initiative (a major Tasmanian initiative looking at how Tasmania could deliver more clean, reliable and cost competitive energy to Australia’s NEM). Identification of promising pumped hydro sites through the atlas also offers opportunities for developers in states such as South Australia and Queensland, which have set ambitious renewables targets and must maintain energy security.

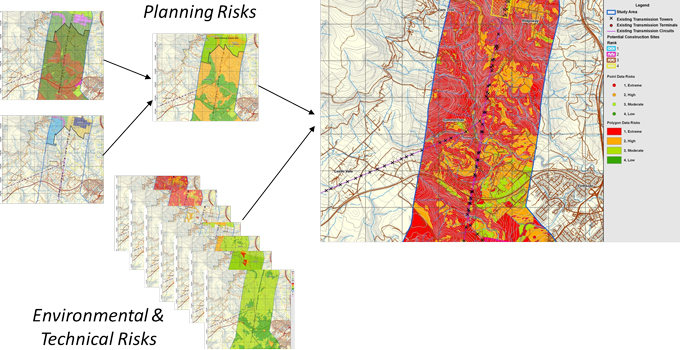

Entura’s Pumped Hydro Atlas of Australia takes into account far more than the basics of identifying ideal topography and a source of water. It also accounts for other practical factors that can make or break a project: such as proximity to and location within the transmission network, land-use constraints and environmental risks, and the practicalities and costs of construction and ongoing operation. This makes it a real-world, relevant resource identifying the best sites for pumped storage projects across the NEM.

Developing the Pumped Hydro Atlas of Australia

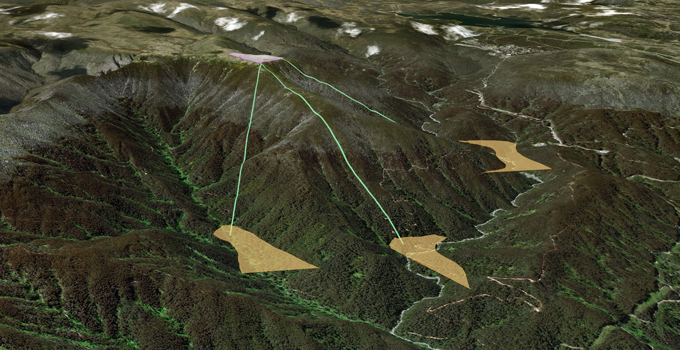

Originally commissioned by Hydro Tasmania, the Pumped Hydro Atlas of Australia was completed in October 2017. The journey began with a literature review, appraising previous studies. This informed the development of a set of rules, assumptions and algorithms for a GIS-based study of different reservoir types and pairing mechanisms, which were tested on pilot sites.

Using these algorithms, more than 200 000 pairing reservoirs were identified across the NEM states (Queensland, New South Wales, Victoria, Tasmania, South Australia and the Australian Capital Territory). State-based heat maps of potential sites for pumped hydro development were prepared, along with a summary of all key characteristics for each pairing reservoir set, such as installed capacity, energy storage, distance from the nearest substation, gross head, approximate headloss in the waterways, and active reservoir volume.

A subsequent stage of refinement prioritised high-potential sites in some states. This process took into account greater practical detail, such as costings, practical engineering aspects, environmental approvals and risks, realistic high-level arrangements, proximity to other generators, and characteristics of hydrology and energy storage. This stage identified more than 5000 unique potential sites, which were then further refined with a set of rules to select the best pairing reservoir at each site. The approximately 5000 sites were reduced to approximately 500 of the most attractive options: those with an average head of more than 300 m with relatively short distances between the reservoirs.

This exhaustive refining process ultimately resulted in a shortlist of twenty promising sites across different states, with a desktop review of geology, high-level engineering arrangements, and approvals requirements. For each site a map was prepared including locality, land use, planning zones, and key characteristics of the potential pumped hydro project.

The Pumped Hydro Atlas of Australia is an example of how applied hydropower engineering can be used to create practical outputs, which are ready to be applied in the real world. Overlaying the outputs of this atlas with any new wind and solar development across the NEM could result in opportunities to invest in dispatchable renewable energy generation hubs capable of replacing thermal generation assets as they retire.

Pumped hydro energy storage will no doubt play a major role in the development and expansion of networks powered by renewable energy – in Australia and around the world. As Australia’s electricity mix evolves, so will the economics of storage. While forecasting revenue for storage projects in the Australian electricity market is still somewhat uncertain, there are many opportunities in both the existing and emerging markets to guarantee project revenues to a level sufficient to satisfy a lender’s requirements. The opportunity for investors seeking a head start in this emerging market is now.

If you would like to discuss how Entura can help you with your pumped hydro or renewable energy project, please contact Richard Herweynen on +61 429 705 127 or Phillip Ellerton on +61 439 010 172.

MORE THOUGHT LEADERSHIP ARTICLES

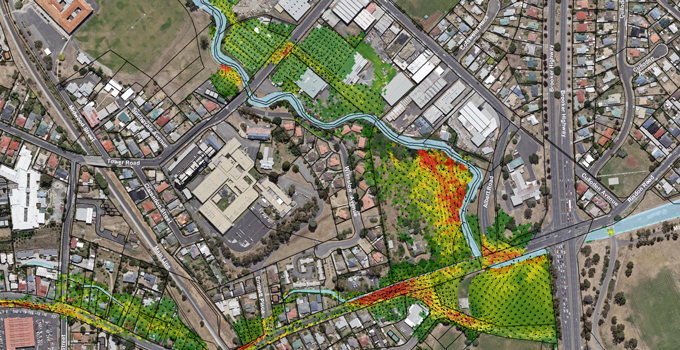

Maximising the benefits of GIS for better business decisions

‘Location, location, location!’ It’s a familiar catch-phrase in the real estate industry, but it’s just as relevant in the power and water sector. Wherever there’s location-related data, a geographic information system will guide better business decisions.

Mobile devices and apps are increasingly using location-based data collected via satellites, drones, LIDAR and other rapidly developing sensing and data capture technologies. With these advances, we are able to find relevant information more quickly and draw on that information to make informed decisions. We’re seeing this proliferate in everyday life through apps that help us navigate, find services and products, and make decisions ranging from the trivial to the profound.

Developers and managers of power and water infrastructure projects who embrace GIS (geographic information systems) stand to gain benefits on an even greater scale. Gathering high-quality spatial information and analysing it to guide business decisions will certainly improve productivity and the bottom line.

Better decisions are the necessary foundation for increased revenue, lower costs, greater efficiency and productivity, and reduced risks. So, if the technology is available and there’s so much to gain, why isn’t GIS being as widely used in the power and water sector as it could be? What may be holding businesses back from fully embracing this powerful and dynamic technology?

Do we really need to use GIS for this project?

All power and water projects involve location – from finding an optimum site for your project, to analysing combinations of spatial data to make the best management decisions or to predict events. Whenever you ask a ‘where?’ question, GIS can help. Where is the asset best located? Where are the constraints or hazards? Where are the reports of previous work done in this area? Where are the customers or opportunities?

In other words, rather than asking whether GIS is needed on a project, consider making GIS a default for every project. The real question should be “how can we maximise the benefits of using spatial data and GIS on this project?” GIS can offer business benefits far beyond the most commonly understood use: making a map.

Data capture in the field can now be streamlined – gone are the days of capturing field data with pen and paper. Users can now collect data on mobile devices, sync to databases while in the field, share data, and generate their own maps, queries and reports. Embracing these advances will save time and enable faster and better decisions.

As well as providing valuable business insights, spatial analysis and location intelligence can greatly improve communication and knowledge sharing – within project teams, with the broader business, and with the community and stakeholders – via tools such as web maps and apps, visual analysis and 3D modelling.

One of the most important applications is the simultaneous analysis of different spatial datasets to provide the best solutions or choices between alternative options, locations, objects and so on. This process is better known as multi-criteria analysis (MCA) and it can be used for many applications.

For example, MCA can be used to find the optimum site for your project taking into account a range of values such as local geology, threatened species, resource availability, land use and terrain, planning restrictions, communities and demographics. Using MCA, you can establish areas of best fit for your project based on thematic overviews of areas of constraint, cost of construction, access and transportation routes.

Risks such as bushfire, weeds, threatened species, pollution sources, landslides and erosion can also be more easily and fully understood, supporting your ongoing site management of such issues.

GIS also links with document management, asset management, business intelligence and enterprise resource planning (ERP) systems. It can act as a portal, creating a central point of easy access, pulling together information and making it available on one of the simplest forms to interpret – a map.

Of course GIS is not the answer to everything, and it is not a standalone platform. However, there’s much it can offer across many different business activities, working together with other business systems.

What about the costs?

The return on investment of using GIS should be positive if it is used appropriately. For site selection of power and water projects, using GIS is a no-brainer. For example, using GIS to find the best site for a wind farm – locating the best winds, minimal constraints, good proximity to existing infrastructure and appropriate land use – will obviously result in vastly greater returns than siting the wind farm in an inferior location.

Some examples may be less immediately apparent, but equally valuable – for example, using GIS to increase efficiencies in everyday workflows. If your workers are taking an extra half hour every time they need to find previous work completed in an area, this time can add up quickly. Or perhaps they can’t find previous information, so work is re-done unnecessarily. These costs will keep adding up. Instead you could use a GIS web map to locate all your previous reports and projects, so that a simple click on a map finds the files and saves hours (if not days) of time.

Do we need specialist software or skillsets?

With most things, you do need specialised skillsets and software to get good results, and of course bad data in equals bad data out. Users of GIS do need to understand and assess the spatial data needs in each application.

You could undertake some GIS work yourself using free or open-source software. However, be aware of the risks of using data or tools that aren’t fit for purpose. Just because you know how to use Microsoft Word, doesn’t mean you could write a detailed report outside your area of expertise!

We have seen cases where coarse-resolution data has been used to infer finer project details and costs, resulting in poor decisions. We have also seen inexperienced operators make invalid assumptions. To get the best results, you need to be sure that you’re using the technology wisely.

If you are engaging a power, water or environmental consultant on a project, they are likely to have access to GIS capability; however, GIS is still often underutilised. When deciding who to engage on your project, ask your consultant how they will maximise the benefits of GIS to produce better outcomes for your project.

To discuss how Entura can help you harness the potential of GIS to improve your power and water project decisions and outcomes, contact Stephen Thomas on +61 3 6245 4511, Patrick Pease or Phillip Ellerton on +61 439 010 172.

About the authors

Stephen Thomas is Team Leader and Senior Technical Officer with Entura, specialising in geographic information systems, 3D visualisation and CAD software. Steve has over twenty-six years of technical experience and specialises in environmental assessments and approvals for engineering surveys and property. He has created 3D models and animations of proposed developments including wind farms, urban landscapes and city frameworks. Steve’s work on the Hobart Waterfront 3D model won an international award in geospatial modelling.

MORE THOUGHT LEADERSHIP ARTICLES

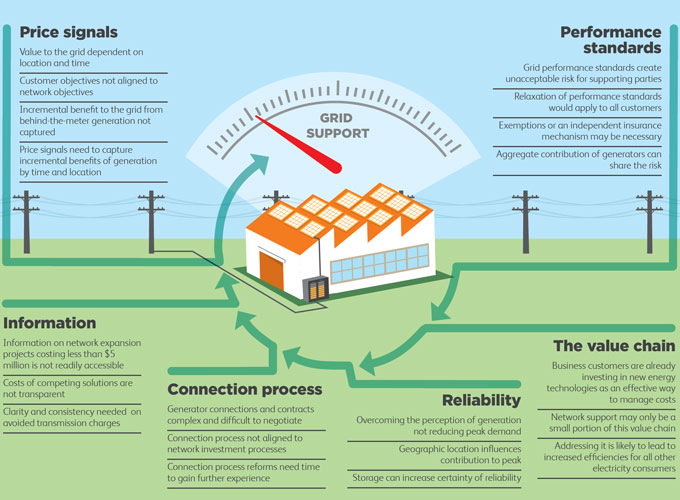

Can commercial solar and storage reduce risk in an evolving electricity grid?

How can distribution network service providers best take advantage of the emerging opportunities presented by commercial solar and storage systems to reduce risk in an evolving electricity grid?

Commercial solar generation (large solar arrays in places such as factories, universities, airports, etc) and other types of mid-scale embedded generation and storage are already adding value to the electricity network, despite emerging in a relatively ad-hoc way in the grid.

For distribution network service providers (DNSPs), forms of embedded renewable generation and storage have typically caused some disruption of standard business models.

However, by better understanding the drivers for commercial solar and storage, and their opportunities for network benefits, DNSPs can take some level of control, reduce risk and build network value.

Opportunities for commercial solar in existing networks

Commercial solar and storage are primarily driven by non-cost-reflective retail tariffs. This means that, despite offering some benefits, commercial solar and storage are unlikely to be delivering their full potential benefits, such as reducing the costs of grid development, reducing peak demand, and increasing grid reliability, ultimately lowering power bills for consumers. In the process, they can also create additional workload for DNSPs, often requiring grid augmentations, development of new materials and procedures, and processing connection applications.

Rather than seeing this as a headache at the fringe of their core business, DNSPs need to be more active in using and incentivising these technologies in places where they add value, such as where they can reduce the costs of building and operating the network. DNSPs need to embrace the fact that these technologies will become a dominant factor in their business over the next 10 to 15 years (if not sooner) and plan accordingly.

This means that DNSPs will need to gain experience and understanding in:

- the technical capabilities of the new technology, including the rapid advances in their ability to provide grid support

- the statistical nature of renewable generation, and why it has already contributed to reducing peak load (and how this relates to type of generation, geographical location, and rates of uptake)

- the business model for proponents, how sensitive this is, and how it can be strongly influenced by subtle incentives to install in areas that are of benefit to the DNSP

- operation of new technologies, in particular battery storage, to understand their control capabilities and limitations, and the economics of their operation

- how best to measure reliability in renewable generation systems and storage, and

- the possibilities offered by forecasting.

Recent Australian Energy Market Commission rule changes provide a new framework under the Australian Energy Regulator to support these kinds of development activities. Under this framework, the Demand Management Incentive Scheme (DMIS) and Demand Management Innovation Allowance (DMIA) will provide significant support for DNSPs to undertake activities that are likely to benefit both electricity customers and DNSPs in the long run, by supporting exploration of new types of non-network solutions.

However, the points listed above are really just the beginning, and DNSPs need to be looking further ahead to new models of supply. At the moment, the price point of renewables and storage mean that many straight-out non-network solutions aren’t financially viable, but of course these technologies are still going in, in increasing numbers, so understanding the broader value chain is essential for leveraging these technologies.

Opportunities for DNSPs from commercial solar and storage in network extension and in-fill

DNSPs need to consider how to incentivise or signal the need for embedded generation and storage in particular areas of their network, and need a plan for managing short-term shortfalls or long-term surplus.

Several DNSPs appear to have network support applications for fringe of grid well in hand through trials (including under the DMIA and DMIS) and are rapidly gaining experience with storage technology. However, network applications in areas with nodal constraints (e.g. at substations), new developments, and incremental benefits have far wider application and implications.

New developments offer two ‘network support’ opportunities, both of which could save money for the developer: the capacity of the connection is reduced (resulting in lower rated transformers, switchgear, etc.), and there is less chance of ‘upstream’ upgrades being required in the network to support the additional load. Cost savings from these opportunities would be weighed against the cost of the battery and solar, taking into account the value of other revenue streams (mainly sale and arbitrage of energy).

As an example, new housing and industrial developments are increasingly looking to minimise their connection capacity by adding commercial solar and storage. In doing so, they are taking on many of the above factors, and inherently making a choice about the value of customer reliability. And this choice will be different for different customers (e.g. a data centre that installs an uninterruptible power supply is a very different customer from an eco-housing development with battery and solar on every house).

Significant opportunities exist for DNSPs to use commercial solar and storage to allow far more flexibility in ‘selecting’ the level of reliability delivered to the development. This will, of course, take into account the value of customer reliability (VCR), but can do so in a far more detailed and localised way than would be the case using VCR based at the level of the State. By tying into the values of residents buying into a ‘green’ suburb, it may be possible to establish a lower VCR (i.e. they may accept occasional additional faults associated with the smaller grid connection and probabilistic nature of the solar and storage capacity).

Ensuring DNSPs benefit from commercial solar and storage

The strategic DNSP needs to fully assess the risks and impacts of new mid-scale embedded generation or storage connections and keep a weather eye as solutions emerge to enable future network support. This requires a range of detailed information.

Entura’s detailed analysis of the commercial, technical and regulatory aspects of commercial solar and storage identifies the key areas that still need to be addressed so that DNSPs, proponents and consumers can fully harness the potential benefits these technologies can offer the grid.

Australia’s Clean Energy Council engaged Entura to conduct this extensive study because we understand the issues facing DNSPs, the regulatory constraints, the technology and its applications, and the multiple revenue streams that make up the business case for its proponents. Our engagement with a wide range of stakeholders and analysis of common and emerging generation technologies and deployment configurations is documented in the Clean Energy Council report Grid Support: Revealing Mid-scale Generation and Storage Potential.

To discuss how Entura can support you to best take advantage of the benefits of mid-scale embedded generation and storage, contact Chris Blanksby on +61 408 536 625, Patrick Pease, or Silke Schwartz on +61 407 886 872.

About the author

Dr Chris Blanksby is a Senior Renewable Energy Engineer at Entura, and Entura’s lead solar energy specialist. In addition to leading the above-mentioned report for the Clean Energy Council, Chris previously led the work on demand-side-management opportunities for the Clean Energy Council. Chris has undertaken and published research on the solar resource in Australia, and has led several due diligence and owner’s engineer projects for wind, solar and microgrid projects in Australia, the Pacific and Asia. Chris is currently leading Entura’s owner’s engineer team assisting the Government of Cook Islands to implement six solar PV microgrid projects, and build capacity towards their 100% renewable target.