THOUGHT LEADERSHIP

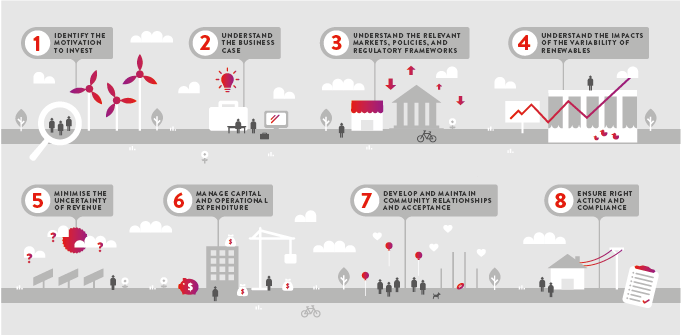

Eight principles for successful investment in renewable energy projects

When you are considering investing in a renewable energy project, a thorough due diligence investigation can identify the costs, benefits and risks, and lead to well-informed decisions.

In practical terms, this is about asking the right questions about the project, distinguishing when an issue is important and when it is not, and prioritising your efforts.

Why prioritise your efforts? Because the unfortunate reality is that most due diligence investigations don’t result in an investment. As consultants, we are aware of this reality, but as part of a larger business that acquires, develops and owns renewable energy assets, we understand that effort and expenditure must produce results.

When we lead renewable energy due diligence investigations, we often start with a quick assessment to establish as soon as possible if there are any ‘show stoppers’. No matter how preliminary or comprehensive the assessment, these eight principles guide our considerations:

1 – Identify the motivation to invest

A thorough due diligence investigation will identify high-level issues such as sovereign risk, right down to detailed technical issues associated with the particular investment opportunity.

Your motivations as the investor will influence the assessment of these risks. It may not simply be all about financial return, but also a desire to limit carbon exposure or to increase corporate social responsibility. And if we understand your business, we can bring a clearer perspective to the assessment.

Traditionally, investors have relied on consultants to assess the technical issues in detail, but have preferred to assess high-level risks ‘in-house’. This approach is understandable, but it may not be making the most of your consultant’s knowledge. Most renewable energy consultants these days have been in the game a long time, and you will find them keen to provide a more holistic assessment of risk.

2 – Understand the business case

As with any investment decision, investors interested in renewable energy projects need to understand the level of investment of financial and human resources required for the project, and the likely returns for that investment – the business case.

Each project will have its own set of issues and risks to identify and potentially mitigate as part of a robust business case. Risks will affect the revenue stream, the cost of the project, and/or the social acceptability of the project.

An experienced due diligence provider can provide value by recognising the difference between issues that will materially affect the project business case and those that will not, or by identifying opportunities where others might only see risks.

3 – Understand the relevant markets, policies and regulatory frameworks

Renewable energy projects are often supported by government policies that recognise the environmental benefits of clean generation and support the revenue stream for the project. It is essential to understand both the commercial market for your energy and this policy environment.

You also need to understand the relevant regulatory frameworks – planning, environmental, electricity grid, corporate governance, taxation, financial, employment, or occupational health and safety. All these factors need to be considered when assessing the cost of the project and the risks associated with the investment.

4 – Understand the impacts of the variability of renewables

Renewable resources such as solar, wind or small run-of-river hydropower schemes generate power with a variable output that can be forecast, but is not necessarily available on demand. This feature of renewable energy can lead to quarterly or annual variations in generation and in revenue that are beyond the control of the owner.

However, renewable projects do not have variable fuel costs. So by weathering the short-term fluctuations of renewable generation through prudent technical and financial risk management, you can achieve greater long-term certainty in your business case than with non-renewable generation projects.

The variability also means that when the resource is available (for example, the sun is shining), you want your project to export energy to the electricity grid without constraint. Therefore, for renewable energy projects, the grid connection arrangements can mean the success or failure of your project.

5 – Minimise uncertainty of revenue

The variable nature of renewable generation can create short-term uncertainty in revenue; however, long-term certainty in revenue is generally a must-have for a renewable energy project looking to sell its power output.

In some markets, set tariffs may be offered from government bodies for renewable projects. In markets with a floating electricity price, long-term power purchase agreements are often sought with counterparties such as retailers or large-scale energy consumers.

There may not be much assistance a consultant can provide on this issue – except to remind you to read the fine print of any agreements and, if the project does not have a confirmed buyer for the power, make sure you know the risks!

In terms of what the project is technically capable of generating, an operational project has more certainty than a development site, and may be more attractive for some investors.

6 – Manage capital and operational expenditure

Renewable energy projects require a large upfront capital expenditure. Depending on your risk appetite as an investor, exposure to risk can be managed through the contractual arrangements with the developer, equipment suppliers and the construction contractor. Comprehensive long-term operations and maintenance agreements are often available, which reduce your risk, but at a cost.

One issue worthy of particular note is construction delays. Investments that are otherwise sound can suffer due to delays in construction, which can have significant impacts on the expenditure and revenue profiles, and the terms of any debt provision.

7 – Develop and maintain community relationships and acceptance

Renewable energy projects operate within communities. There will be a range of attitudes towards your project and relationships to manage, and it will be up to you to develop and maintain a healthy relationship with the community.

Your community may see your project as a major contributor to the local economy through direct employment and indirectly through contracting. The community may even expect you to play a leading role in supporting local community activities through sponsorship and other activities.

8 – Ensure right action and compliance

An opportunity to invest in a renewable energy project might occur at any stage of the project. Regardless, the nature of the due diligence is usually very similar – have the right actions have been undertaken, does the project comply with its commitments, and will it continue to comply into the future?

Because Entura is part of Hydro Tasmania, Australia’s largest renewable energy producer, we understand what it means to live with the full consequences of investment decisions and risks. So we approach due diligence for our clients in the same way we would if the investment opportunity was our own.

That means developing a full understanding of the proposed project, discovering any risks that could prevent its success, and finding the best ways to make the most of the project’s strengths and avoid any possible weaknesses.

If you are seeking to invest in renewable energy, Entura can assist you with practical, expert due diligence services for proposed or operational projects in the Asia-Pacific region. Please contact Patrick Pease or Silke Schwartz on +61 407 886 872.

About the author

Seth Langford is a specialist renewable energy engineer at Entura and has been working in the wind industry for more than ten years. Seth has been involved with major wind farm projects as a technical specialist and a team leader for feasibility studies and due diligence projects in India, China, Australia, Sri Lanka, South Africa and New Zealand. Seth has spent considerable time assessing greenfield and operational wind farms on behalf of developers wishing to acquire wind farm projects.

MORE THOUGHT LEADERSHIP ARTICLES

26 May, 2015