Overcoming potential roadblocks when developing a solar farm

If you are planning a utility-scale solar development, how can you avoid the potential pitfalls and maximise success?

We’ve heard the equation so many times, and it seems so simple: take plenty of sun, add the rising costs of energy, factor in the rapidly falling costs of solar technologies, and throw in an increasing trend towards fossil fuel divestment and social and environmental credit for supporting renewable energies, and you’ve got a no-brainer: solar power is good business.

But while Australia ranks amongst the world leaders for the uptake of smaller scale solar, there is still enormous untapped potential in the utility-scale solar photovoltaic industry. The country has a very large area of high insolation, the solar resource is less variable than wind, solar farms don’t usually have the same level of impacts or objections as wind projects, and sources of funding appear to favour solar over other renewables.

So what could possibly go wrong? Well, there are a number of hidden risks that could have the potential to ‘make or break’ a project.

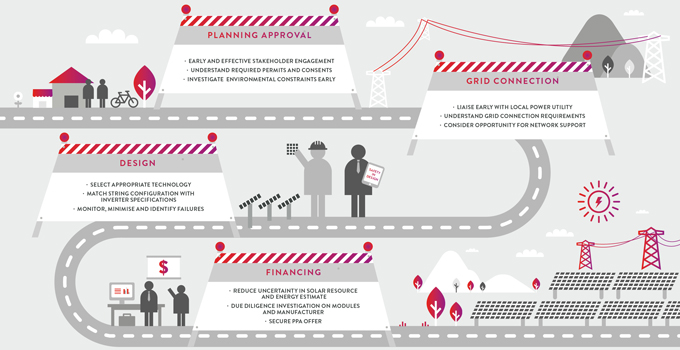

Potential roadblocks when developing a solar project

In each phase of a renewable energy project, there are some potential roadblocks and challenges that could cause costly delays or reduce your expected return. The more you can do as early as possible to identify, understand and resolve these challenges, the more likely your project is to succeed.

The stages of a utility-scale solar project (site identification, feasibility assessment, approvals, financial close, construction and operation), and the possible pitfalls in each stage, are reasonably similar to those encountered in all renewable developments regardless of technology.

Having worked on a wide range of renewable projects in Australia, we have learned some key lessons in how to successfully bring renewable energy projects to completion and operation, and how to avoid costly surprises, delays and other setbacks.

PLANNING APPROVAL

If you’ve already been involved in developing any renewable energy project, you’ll know that to maximise your chance of smooth and timely progress, one of the most important investments is early and effective stakeholder engagement. This includes identifying the main issues affecting the social acceptance of your project, such as the history of past projects, council objectives, permit requirements and the requirements of the local power utility.

No doubt, you’ll have experience in developing a comprehensive community engagement plan, with open, honest and extensive consultation. You’ll already have navigated the environmental constraints at project sites, including fauna, flora, Aboriginal heritage, historical heritage, access, stormwater and erosion management, among others. So, in terms of the planning process, is there ‘nothing new under the sun’ when it comes to solar?

Utility solar projects may look reasonably easy, and to some extent this is true. However, most of the same planning processes and timelines will apply as for other developments (including the same long turn-around times if you need to revise anything during the process, or expand the scale of the project). Therefore, as you would for any project, be sure to fully explore and understand the development controls that apply to the site, through the local planning scheme or environmental plan, the various permits and consents that are required to authorise the use and development, and the level of assessment that will be required for permits. And ensure that the specialist studies undertaken are as high quality and comprehensive as you would for any other development.

As well, keep particularly alert for project-specific pitfalls such as airport reflections, very high ground coverage and penetration, working in flood zones, and so on.

Learn more about planning for solar success.

GRID CONNECTION

Proximity to the grid is one of the most important criteria for selecting a site (along with the available solar resource, suitable topography and land zoning). We strongly recommend engaging early with the power utility to ensure capacity and access is available, so that you can export your generation without curtailment. There is also now an extensive range of published information on distribution networks, including zone substation connection capacity, which can provide valuable insights into the best place to connect.

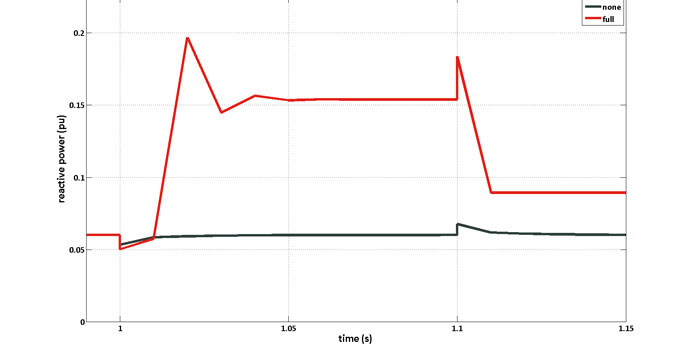

Although your dynamic modelling and connection studies will include the obvious assessments (such as reactive power capability and fault levels), your project will also benefit from thorough investigation of generating system response to frequency or voltage disturbances, impacts on the network capability, and remote monitoring.

Consideration of network support is another important element of discussions with the power utility and opportunities should be investigated at an early stage as they can shape the details of plant design. In the long term, these supports may form the basis for additional revenue streams or competitive advantage where network stability constraints arise.

Learn more about the art of solar grid connection.

DESIGN

In relation to the design of your solar project, how confident are you that you are using the most appropriate technology, such as modules or tracking systems (where practical and economically viable)? As you select your equipment, be sure that it is certified to the relevant Australian standard, and that all parts are compliant. You should also check that you have included sufficient isolation points, and whether fuse, switchgear or circuit breakers are the most appropriate.

When you are selecting and dimensioning your inverter, consider how it will react if instantaneous condition exceeds the maximum power rating. Does the attempt to change voltage to manage the condition lead to shut down? How can you prevent this, and how did you derive your optimum inverter concept, your string and DC/AC ratio?

In your overall design, consider the implications of a failure in the system. By adopting an AC electrical ring topology, for example, you could ensure the minimum loss of generation. You should also investigate how you will monitor failures and identify faulty modules within an array of thousands, and how to minimise near and far shading on parts of the arrays.

Another important aspect is to implement a ‘Safety in Design’ methodology and check that construction workers and your ongoing personnel have the appropriate training to operate DC and AC equipment and to conduct procedures both effectively and safely.

While almost all aspects of solar plant design appear simple and generally low risk, we know that careful consideration of plant lifecycle can lead to more efficient construction, operation and refurbishment. Good design can reduce failures, lost production and maintenance requirements. This is true of any project, solar is no exception.

Here are the six essentials for solar farm design.

FINANCING

Unlocking secure and adequate project finance is about much more than calculations of financial return on investment. It’s also about offering the investor confidence that your project has adequately considered and planned for all potential risks across the spectrum of financial, technical, stakeholder, community and environmental issues.

To bring your project to financial close you need an offtake agreement of sufficient length, a grid connection agreement, land agreements for the site and transmission route, developmental approval, a bankable yield estimate and a selected delivery model.

Financiers are more likely to provide better terms if there is less uncertainty for the revenue stream over the debt financing period, so the longer the warranty period on the delivery contract the better. Consider how you will monitor defects, and investigate third-party warranty insurance for the lifetime of the project.

Another key factor in offering confidence to investors is the reliability of the site’s solar resource assessment and the project’s energy yield. We recommend that a variety of reliable and appropriate solar resource datasets, with at least 10 years of data, be considered, as well as short-term on-site ground-based measurements. Financiers will also expect that you factor in the possible year-to-year variation and the uncertainties of resource measurement and energy estimation, in addition to loss assumptions and degradation.

A thorough due diligence investigation on your modules will mitigate risk and offer your investors further certainty and confidence. When assessing the modules, make sure you look at the technical test data and its implications for failure rates and degradation, but also explore the track record and capacity of the manufacturer, particularly considering the risk of manufacturer insolvency.

Take a closer look at some key risks often scrutinised by lenders and investors.

If you need support with any aspect of your solar project, or would like to discuss how Entura can help you maximise your project’s success, contact Silke Schwartz on +61 407 886 872 or Patrick Pease.

About the author

Silke Schwartz has over 15 years’ experience in the renewable energy industry in Australia and around the world. She has been involved in the technical due diligence of renewable energy projects in Australia, India and China, including condition assessments, technical assessments and performance reviews.

MORE THOUGHT LEADERSHIP ARTICLES

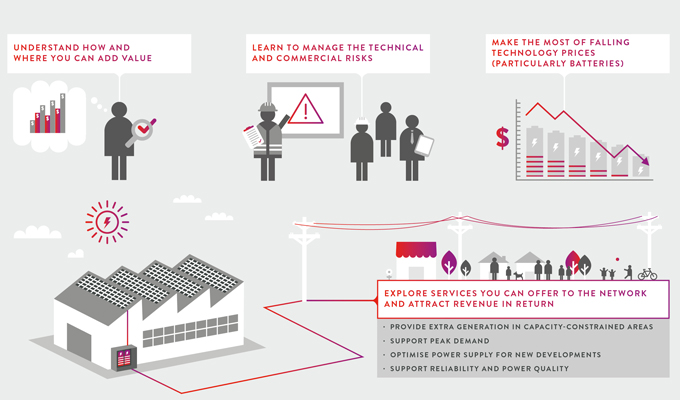

How can businesses get more value from their investment in solar and storage?

What do you need to know to minimise your risk and maximise the value of your commercial-scale solar and storage system?

In our fast-moving environment, the time for businesses to act on solar and storage is now. Early movers are well placed to capture the best opportunities from commercial solar generation (large solar arrays in places such as shopping malls, warehouses, universities or airports) and other types of mid-scale embedded generation – and, notably, network operators are already moving ahead with some of their own innovations and installations to add value to the electricity network.

The business case for investments in commercial solar and storage are made almost entirely on the basis of projected savings on electricity bills assuming continuation of current tariffs. However, current tariff structures don’t reflect the way network operators experience costs to supply electricity, and the threat of future adjustments can make these sizeable investments risky for astute businesses. So how can you make the best of the available opportunities and add value to your investment?

As you prepare to act, you need to understand some key factors:

- how and where you can add value

- how to benefit financially from embedded generation and storage by working with network service providers (i.e. what schemes are available)

- how to manage the technical and commercial risks, and

- how to make the most of falling technology prices (particularly for batteries).

Behind the meter, or grid support?

Most existing embedded generation is rooftop solar PV installed ‘behind the meter’, reducing the business’s electricity bills, generating the business’s energy needs, and improving the business’s overall carbon footprint. The size of these systems has usually closely matched the load, and export to the grid has been less of a priority.

However, as storage technologies become cheaper and more readily available, greater scope emerges for renewable embedded generation to export power into the grid: providing extra generation in capacity-constrained areas, supporting peak demand, and reducing or deferring the need for grid upgrades or extension at the fringes of the grid or in new developments. They can also support reliability and power quality standards.

In this market, businesses considering solar and storage need to think of themselves as project developers. One way for developers to capitalise on the available prospects, minimise risk, and add value to a commercial embedded generation investment is to work out how to turn these possible forms of network support into additional revenue streams.

Benefits of network support

When embedded generation and storage adds value to the network, significant benefits are available for both commercial generators and network operators, and these benefits can be shared. Yet, despite these opportunities, there are still very few examples of mid-scale systems being recognised to provide network support.

Network support is typically where a system that is not part of the traditional network, such as solar, wind, or batteries, helps the network to deliver its function of reliable electricity supply to customers. As a simple example, a network operator facing rising demand in a specific area would traditionally plan for a substation upgrade. But if it costs less, they may consider a network support strategy to install local embedded generation and storage.

Whilst regulatory reform is underway to formalise parts of this, plenty of potential opportunities exist now. To make the most of these options, proponents need a good understanding of the key issues, and close collaboration with network service providers.

New developments, new possibilities

Opportunities for network support at existing premises can be very valuable, but these only exist in specific locations. Such prospects are certainly worth exploring; however, it is in the context of new developments that opportunities are becoming most abundant.

Where a new connection is required for a residential development, a large shopping complex or a similar large development, an opening exists to optimise the combination of baseload power supply from the network with peaking power from embedded generation such as commercial solar and/or storage. This option is particularly effective where the local resource coincides with the load, such as a good daytime solar resource that matches a daytime shopping centre load.

The embedded generation or storage may be able to significantly reduce the capacity requirements for the network connection, and alleviate broader network constraints that would need to be addressed if the entire additional load were drawn from the network. In all cases, battery storage increases the available possibilities by addressing instances where peak demand exists but generation output is not available, or where renewable energy generation does not coincide well with load.

Preparing for action

A good place to start exploring the possibilities for commercial solar and storage in more detail is Australia’s Clean Energy Council report Grid Support: Revealing Mid-scale Generation and Storage Potential. The Clean Energy Council engaged Entura to conduct this extensive study because we understand the regulatory constraints, the technology and its applications, and the multiple revenue streams that make up the business case for its proponents.

The report is based on detailed analysis of the commercial, technical and regulatory aspects of commercial solar and storage, and identifies the key areas that still need to be addressed so that network operators and commercial solar developers can fully harness the potential benefits these technologies can offer the grid.

To discuss how Entura can support you to best take advantage of the benefits of mid-scale embedded generation and storage, contact Chris Blanksby on +61 408 536 625, Patrick Pease or Silke Schwartz on +61 407 886 872.

About the author

Dr Chris Blanksby is a Senior Renewable Energy Engineer at Entura, and Entura’s lead solar energy specialist. In addition to leading the above-mentioned report for the Clean Energy Council, Chris previously led the work on demand-side-management opportunities for the Clean Energy Council. Chris has undertaken and published research on the solar resource in Australia, and has led several due diligence and owner’s engineer projects for wind, solar and microgrid projects in Australia, the Pacific and Asia. Chris is currently leading Entura’s owner’s engineer team assisting the Government of Cook Islands to implement six solar PV microgrid projects, and build capacity towards their 100% renewable target.

MORE THOUGHT LEADERSHIP ARTICLES

Finding the right value in dynamic modelling of renewables

What value can you derive for renewable energy projects through developing accurate models? When is the effort and expense involved justified by potential benefits?

Renewable energy project developers are often confronted with seemingly large costs to develop accurate dynamic models of their projects. This can be due to regulation, or it may be because that level of accuracy, potentially in excess of the regulatory requirements, adds value to the project. It may be that the modelling actually allows the project to remain viable in the face of connection issues.

On some levels it’s easy to say the regulations require accurate modelling. However, for any renewable energy project there is a level of modelling that will be the right fit , and the regulations shouldn’t ask for more than that without good reason. So let’s look at the relative value of accurate modelling in various contexts, and then later we can see if there’s a mismatch between that value and regulatory regimes.

The requirements for power system modelling of generating units vary from place to place, but as ‘traditional’ generation levels recede and power electronics and intermittency gain more than a foothold in the power system, accurate modelling will increase in importance and value.

The aims of these models cover three levels:

- Level 1: Does my plant work?

- Level 2: Does my plant interact appropriately with the nearby network?

- Level 3: Does my plant interact appropriately with the power system as a whole?

Accurate modelling can add value at any of these levels, but the degree of effort required to release that value depends on the type of project, the type of network and the location in the network.

The issue impacts all renewable energy projects but let’s take a wind farm as an example and move it around the network to explore this.

Small wind farm in the distribution network

Let’s build a 10 MW wind farm and connect it close to a distribution substation on a 33 kV feeder. At this size, most of the ‘does my plant work?’ question is answered by the off-the-shelf inverter controls, so little value is to be gained at that level.

However, the interaction of the plant with the network and nearby customers is critical. The connection point is close to other customers and so the variability of the wind farm can impact the quality of the neighbours’ supply.

Accurate modelling here gives certainty that there’ll be no surprises at commissioning. Imagine convincing a network service provider that your flicker indices are OK, only to have the neighbouring plant force you to redesign or curtail your operations after commissioning. That has real project impact and possibly brand impact too.

Larger wind farm in the sub-transmission network

What if we move our wind farm to the remote end of a 132 kV line and build it ten times bigger? Now we don’t have any neighbours, although we could have some in the future. We have a stability problem because of the long line, so we now need auxiliary plant (e.g. a capacitor bank) to help control voltage and hence maintain production.

We’ve got a plant that has to cater for an external requirement (level 2) but that then implies an internal control or coordination requirement (level 1).

In this scenario, our models’ accuracy helps with internal design and, as a results, saves commissioning time. It also helps optimise production by clearly communicating the control actions of our plant to the wider system model. This allows the degree of stability improvement to be accurately characterised and so constraints are not arbitrarily applied. The business-case levels of production are preserved.

Large wind farm in the transmission network

If we move this large plant to a 500 kV connection point and triple its size, it’s almost akin to the scale of our 10 MW plant back on the 33 kV. Now we’re less interested in voltage controls due to the high fault levels at the connection point. It’s very difficult to see the influence of the wind farm’s controls on the surrounding network. The only possible value now is related to system strength and fault-ride-through phenomena (level 3).

This now requires accurate modelling of a smaller subset of controls, but it’s interacting with the whole system. In a strong system these issues are generally negligible. In a weak network, they’re critical. So, for this example, the value is derived from integrated design of the controls to ensure system compatibility (i.e. no constraints). The value stems from efficiency and effectiveness at levels 1 and 3. The value is in gaining connection, preserving energy production and streamlining commissioning.

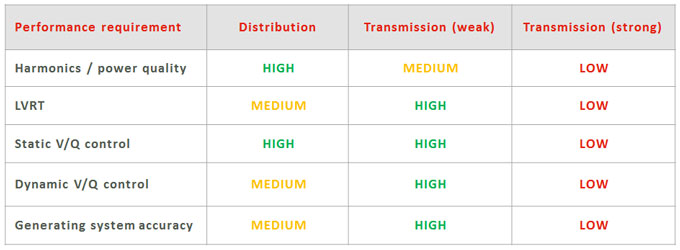

The following tables summarises these three examples. It shows my opinion on the value of dynamic model accuracy to projects connected at various levels of the electricity grid. Note there is never a complete lack of value in having accurate models . Also note that this is relative value.

The cost of accurate modelling may not vary much across these three connection levels but the value it brings to a project does. The table shows an estimation of the value that model accuracy brings relative to the connection point strength and what aspects of the project it helps support.

So if you’re considering a wind farm, or any generation project, don’t forget the value that accurate modelling may bring to that project, but be mindful that this value may be limited due to the nature of the system and locale that you’re connecting into.

The art is to find the ‘Goldilocks Zone’ between the regulatory requirements for model accuracy, production loss through avoidable constraints and modelling effort. Too much or too little attention to these issues leads to unrealised project value. If we find the right balance, it’ll be just right.

If you would like to find out more about how Entura can help you adapt successfully to the rapidly changing market for electricity generation and energy services, contact Donald Vaughan on +61 3 6245 4279 or Silke Schwartz on +61 407 886 872.

This author originally presented on this topic at the Clean Energy Council Wind Industry Forum in March 2016.

About the author

Donald Vaughan is Entura’s Technical Director, Power. He has more than 25 years of experience providing advice on regulatory and technical requirements for generators, substations and transmission systems. Donald specialises in the performance of power systems. His experience with generating units, governors and excitation systems provides a helpful perspective on how the physical electrical network behaves and how it can support the transition to a high renewables environment.

MORE THOUGHT LEADERSHIP ARTICLES

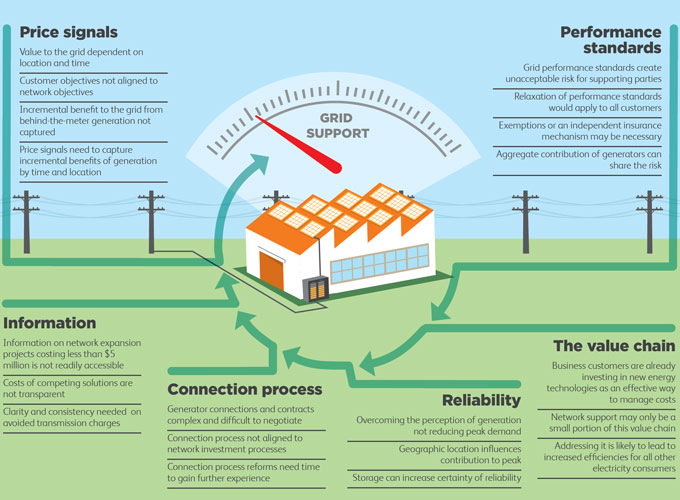

Can commercial solar and storage reduce risk in an evolving electricity grid?

How can distribution network service providers best take advantage of the emerging opportunities presented by commercial solar and storage systems to reduce risk in an evolving electricity grid?

Commercial solar generation (large solar arrays in places such as factories, universities, airports, etc) and other types of mid-scale embedded generation and storage are already adding value to the electricity network, despite emerging in a relatively ad-hoc way in the grid.

For distribution network service providers (DNSPs), forms of embedded renewable generation and storage have typically caused some disruption of standard business models.

However, by better understanding the drivers for commercial solar and storage, and their opportunities for network benefits, DNSPs can take some level of control, reduce risk and build network value.

Opportunities for commercial solar in existing networks

Commercial solar and storage are primarily driven by non-cost-reflective retail tariffs. This means that, despite offering some benefits, commercial solar and storage are unlikely to be delivering their full potential benefits, such as reducing the costs of grid development, reducing peak demand, and increasing grid reliability, ultimately lowering power bills for consumers. In the process, they can also create additional workload for DNSPs, often requiring grid augmentations, development of new materials and procedures, and processing connection applications.

Rather than seeing this as a headache at the fringe of their core business, DNSPs need to be more active in using and incentivising these technologies in places where they add value, such as where they can reduce the costs of building and operating the network. DNSPs need to embrace the fact that these technologies will become a dominant factor in their business over the next 10 to 15 years (if not sooner) and plan accordingly.

This means that DNSPs will need to gain experience and understanding in:

- the technical capabilities of the new technology, including the rapid advances in their ability to provide grid support

- the statistical nature of renewable generation, and why it has already contributed to reducing peak load (and how this relates to type of generation, geographical location, and rates of uptake)

- the business model for proponents, how sensitive this is, and how it can be strongly influenced by subtle incentives to install in areas that are of benefit to the DNSP

- operation of new technologies, in particular battery storage, to understand their control capabilities and limitations, and the economics of their operation

- how best to measure reliability in renewable generation systems and storage, and

- the possibilities offered by forecasting.

Recent Australian Energy Market Commission rule changes provide a new framework under the Australian Energy Regulator to support these kinds of development activities. Under this framework, the Demand Management Incentive Scheme (DMIS) and Demand Management Innovation Allowance (DMIA) will provide significant support for DNSPs to undertake activities that are likely to benefit both electricity customers and DNSPs in the long run, by supporting exploration of new types of non-network solutions.

However, the points listed above are really just the beginning, and DNSPs need to be looking further ahead to new models of supply. At the moment, the price point of renewables and storage mean that many straight-out non-network solutions aren’t financially viable, but of course these technologies are still going in, in increasing numbers, so understanding the broader value chain is essential for leveraging these technologies.

Opportunities for DNSPs from commercial solar and storage in network extension and in-fill

DNSPs need to consider how to incentivise or signal the need for embedded generation and storage in particular areas of their network, and need a plan for managing short-term shortfalls or long-term surplus.

Several DNSPs appear to have network support applications for fringe of grid well in hand through trials (including under the DMIA and DMIS) and are rapidly gaining experience with storage technology. However, network applications in areas with nodal constraints (e.g. at substations), new developments, and incremental benefits have far wider application and implications.

New developments offer two ‘network support’ opportunities, both of which could save money for the developer: the capacity of the connection is reduced (resulting in lower rated transformers, switchgear, etc.), and there is less chance of ‘upstream’ upgrades being required in the network to support the additional load. Cost savings from these opportunities would be weighed against the cost of the battery and solar, taking into account the value of other revenue streams (mainly sale and arbitrage of energy).

As an example, new housing and industrial developments are increasingly looking to minimise their connection capacity by adding commercial solar and storage. In doing so, they are taking on many of the above factors, and inherently making a choice about the value of customer reliability. And this choice will be different for different customers (e.g. a data centre that installs an uninterruptible power supply is a very different customer from an eco-housing development with battery and solar on every house).

Significant opportunities exist for DNSPs to use commercial solar and storage to allow far more flexibility in ‘selecting’ the level of reliability delivered to the development. This will, of course, take into account the value of customer reliability (VCR), but can do so in a far more detailed and localised way than would be the case using VCR based at the level of the State. By tying into the values of residents buying into a ‘green’ suburb, it may be possible to establish a lower VCR (i.e. they may accept occasional additional faults associated with the smaller grid connection and probabilistic nature of the solar and storage capacity).

Ensuring DNSPs benefit from commercial solar and storage

The strategic DNSP needs to fully assess the risks and impacts of new mid-scale embedded generation or storage connections and keep a weather eye as solutions emerge to enable future network support. This requires a range of detailed information.

Entura’s detailed analysis of the commercial, technical and regulatory aspects of commercial solar and storage identifies the key areas that still need to be addressed so that DNSPs, proponents and consumers can fully harness the potential benefits these technologies can offer the grid.

Australia’s Clean Energy Council engaged Entura to conduct this extensive study because we understand the issues facing DNSPs, the regulatory constraints, the technology and its applications, and the multiple revenue streams that make up the business case for its proponents. Our engagement with a wide range of stakeholders and analysis of common and emerging generation technologies and deployment configurations is documented in the Clean Energy Council report Grid Support: Revealing Mid-scale Generation and Storage Potential.

To discuss how Entura can support you to best take advantage of the benefits of mid-scale embedded generation and storage, contact Chris Blanksby on +61 408 536 625, Patrick Pease, or Silke Schwartz on +61 407 886 872.

About the author

Dr Chris Blanksby is a Senior Renewable Energy Engineer at Entura, and Entura’s lead solar energy specialist. In addition to leading the above-mentioned report for the Clean Energy Council, Chris previously led the work on demand-side-management opportunities for the Clean Energy Council. Chris has undertaken and published research on the solar resource in Australia, and has led several due diligence and owner’s engineer projects for wind, solar and microgrid projects in Australia, the Pacific and Asia. Chris is currently leading Entura’s owner’s engineer team assisting the Government of Cook Islands to implement six solar PV microgrid projects, and build capacity towards their 100% renewable target.

MORE THOUGHT LEADERSHIP ARTICLES

Binary states: the rise of the switching controller

The security of an electricity network is threatened by the rise of sophisticated controls on modern generating equipment. These controls lead to complex interactions with the electricity network and must be managed carefully to maintain reliable system security.

Transient stability power system modelling has almost always been the cosy domain of Laplace transforms and smooth, linear controls. The rise and abundance of power electronics in wind turbines and solar PV is changing this and adding a degree of discomfort.

These new controllers switch control modes based on internal and external variables, and as such introduce a new model phenomenon, the switch controller action. A switched controller can be particularly difficult to model accurately as it invariably switches based on an imperfect measurement of a process quantity, coupled with a time delay.

The switch will operate if the process quantity remains out of tolerance for the delay period. The imperfection in measurement can make it hard to accurately predict when or if a switching controller will operate. This can lead to a ‘Schrödinger’s cat’ scenario: the simulation continues past the switching point but we never know whether it should have switched or not, and if it had switched would the result be more or less valid? The simulation could just as correctly be in either state. Argh!

One school of thought is that more accurate and less assumptive modelling practice (such as using electro-magnetic transient simulations) might reduce this problem. However, it is highly unlikely that this form of modelling will deliver all the gains that its proponents expect. Rather, some conditions are likely to still give rise to the switching uncertainty, even with a much higher modelling cost.

Confronted with this uncertainty, how can we ensure that the modelling provides a useful insight into the limits of system operation? We’ll look at three scenarios: generator integration, system model validation, and system planning.

Generator integration

For generator integration, we typically define a set of boundary conditions and extreme event scenarios and determine whether the new generator is able to be connected within the system technical standards. This approach almost always ensures operation of the switching controllers that protect a generator from abnormal conditions, and there is no ambiguity of outcome. All good, job done? Well, no!

What if a slightly less severe system event leads to a condition in which the switching controller doesn’t activate but really should have? That’s a problem. This uncertainty requires us to define a much more complex set of scenarios to assure ourselves that a generator will comply with the technical standards.

System model validation

To validate system models, we generally measure responses from generating units and the system, and this tells us how the system and the generating units have behaved. So far, so good. Although, we don’t always know the severity of the instigating fault with any certainty, and this degree of freedom can open the dreaded window of switching controller uncertainty. Again, two possibilities exist in the model space: switching or not.

We know which is right, but is it fair to assume that the model inaccuracy suggested by comparison is entirely due to the generator with the switching controller? Um, well, probably not, but sometimes, yes. This is perhaps more difficult to resolve because it’s hard to unpick the sum of small inaccuracies in the system model from the clearly aberrant behaviour of the switching controller since the aberrant behaviour may be due to those summed inaccuracies.

System planning

The number of scenarios explored in system planning studies leads us to try to ignore the contributions of single generating units, or at least to assume accuracy in those contributions. Limits to system dispatch are established based on breakpoints such as transient stability and damping ratios. But how do we know we’re studying the correct, most onerous events? Severe events will always lead to switching controllers operating. Less severe events lead to hit-and-miss operation and potentially less stable system operation at potentially lower flows, so they must become part of our planning simulation considerations.

The rise of the switching controller and the uncertainty that it brings is a worrying development , with no easy work-around. Being aware of the conundrum should lead to accounting for it in some way. When the problem first arises during connection studies, the results at this stage can inform validation tests to increase the certainty of the modelling of the switching controller. Understanding the sensitivity of the controller to voltage and frequency variations and imbalance should provide an appreciation of the need for more advanced modelling, or not.

Switching controller uncertainty demands due consideration from network simulators lest the security of the power system is compromised and we all suffer.

If you would like to find out more about how Entura can help you adapt successfully to the rapidly changing market for electricity generation and energy services, contact Donald Vaughan on +61 3 6245 4279.

About the author

Donald Vaughan is Entura’s Technical Director, Power. He has more than 25 years of experience providing advice on regulatory and technical requirements for generators, substations and transmission systems. Donald specialises in the performance of power systems. His experience with generating units, governors and excitation systems provides a helpful perspective on how the physical electrical network behaves and how it can support the transition to a high renewables environment.

MORE THOUGHT LEADERSHIP ARTICLES

‘Sundown, sunrise’ or ‘reform or die’?

The Grattan Institute’s recently released report ‘Sundown, sunrise’ observes that household solar PV will soon be cost-competitive under existing tariff structures, while at the same time bemoaning the subsidies it has attracted, and the uneven burden of these subsidies on all network users.

But it’s important to read beyond the executive summary.

Knee-jerk reactions

The report has been criticised for headlining the imbalance between the costs and benefits of household solar. Critics argue that the Grattan Institute’s model is too narrow, and doesn’t account for the other benefits of the high levels of subsidies to date.

But focusing our attention solely on the details of this aspect of the report may be crowding out some of its more important findings.

A fair share

That we now have a credible and viable solar PV industry in Australia shows the success of the subsidy arrangements that currently exist. The retirement of these subsidies means that they will play less of a role in the future but the impact of PV will only grow. Dwelling on this specific issue is a distraction and almost irrelevant for future policy concerns.

Ultimately, we want everyone to pay their fair share.

Former high feed-in tariffs or high subsidies for solar PV installation led to solar customers gaining either a disproportionate or overstated amount of the value created by their solar installation. At the same time, the rise of solar PV has exacerbated the effect of declining energy use on the economics of the grid.

In the long run, we must try to address both of these issues (and a few more besides!) if we are to make the best use of these emerging technologies without wastefully underutilising existing network infrastructure and generation capability.

Looking into the future

If we accept that past arrangements had unintended consequences, we can turn our attention to the insights the report contains about the possibilities for achieving better future outcomes. I personally don’t believe the electricity industry is incapable of adapting (more on this here).

The report’s insights about the future of the network, the solar industry and energy storage lead to the following conclusions:

- Existing tariffs do not properly account for the network costs and network benefits of distributed solar PV and so some tariff reform is needed to address this.

- Existing regulations may not create optimal outcomes for networks or network customers.

- Network planning processes don’t always fully consider distributed generation or non-network solutions as potentially beneficial alternatives to replacing assets or augmenting the network.

The report offers some early suggestions about how tariffs, planning rules, asset valuation and regulation should be adjusted to address the looming challenges, avoid further entrenchment of disparity between costs and benefits and possibly harness some untapped benefits from solar and storage.

This is the time to focus our thinking on how we can correctly incentivise distributed generation, large-scale generation, loads and network developments… because we know that today’s arrangements won’t be right for tomorrow.

About the author

Donald Vaughan is Entura’s Technical Director, Power. He has more than 25 years of experience providing advice on regulatory and technical requirements for generators, substations and transmission systems. Donald specialises in the performance of power systems. His experience with generating units, governors and excitation systems provides a helpful perspective on how the physical electrical network behaves and how it can support the transition to a high renewables environment.

MORE THOUGHT LEADERSHIP ARTICLES

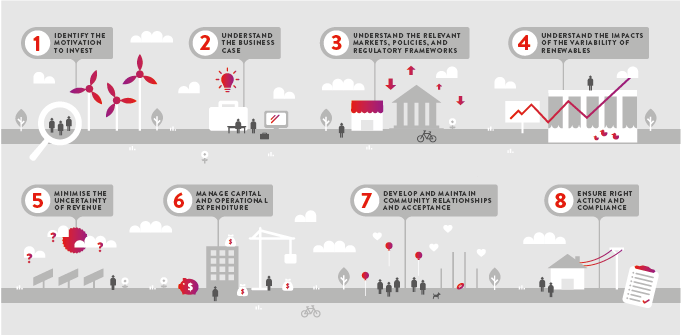

Eight principles for successful investment in renewable energy projects

When you are considering investing in a renewable energy project, a thorough due diligence investigation can identify the costs, benefits and risks, and lead to well-informed decisions.

In practical terms, this is about asking the right questions about the project, distinguishing when an issue is important and when it is not, and prioritising your efforts.

Why prioritise your efforts? Because the unfortunate reality is that most due diligence investigations don’t result in an investment. As consultants, we are aware of this reality, but as part of a larger business that acquires, develops and owns renewable energy assets, we understand that effort and expenditure must produce results.

When we lead renewable energy due diligence investigations, we often start with a quick assessment to establish as soon as possible if there are any ‘show stoppers’. No matter how preliminary or comprehensive the assessment, these eight principles guide our considerations:

1 – Identify the motivation to invest

A thorough due diligence investigation will identify high-level issues such as sovereign risk, right down to detailed technical issues associated with the particular investment opportunity.

Your motivations as the investor will influence the assessment of these risks. It may not simply be all about financial return, but also a desire to limit carbon exposure or to increase corporate social responsibility. And if we understand your business, we can bring a clearer perspective to the assessment.

Traditionally, investors have relied on consultants to assess the technical issues in detail, but have preferred to assess high-level risks ‘in-house’. This approach is understandable, but it may not be making the most of your consultant’s knowledge. Most renewable energy consultants these days have been in the game a long time, and you will find them keen to provide a more holistic assessment of risk.

2 – Understand the business case

As with any investment decision, investors interested in renewable energy projects need to understand the level of investment of financial and human resources required for the project, and the likely returns for that investment – the business case.

Each project will have its own set of issues and risks to identify and potentially mitigate as part of a robust business case. Risks will affect the revenue stream, the cost of the project, and/or the social acceptability of the project.

An experienced due diligence provider can provide value by recognising the difference between issues that will materially affect the project business case and those that will not, or by identifying opportunities where others might only see risks.

3 – Understand the relevant markets, policies and regulatory frameworks

Renewable energy projects are often supported by government policies that recognise the environmental benefits of clean generation and support the revenue stream for the project. It is essential to understand both the commercial market for your energy and this policy environment.

You also need to understand the relevant regulatory frameworks – planning, environmental, electricity grid, corporate governance, taxation, financial, employment, or occupational health and safety. All these factors need to be considered when assessing the cost of the project and the risks associated with the investment.

4 – Understand the impacts of the variability of renewables

Renewable resources such as solar, wind or small run-of-river hydropower schemes generate power with a variable output that can be forecast, but is not necessarily available on demand. This feature of renewable energy can lead to quarterly or annual variations in generation and in revenue that are beyond the control of the owner.

However, renewable projects do not have variable fuel costs. So by weathering the short-term fluctuations of renewable generation through prudent technical and financial risk management, you can achieve greater long-term certainty in your business case than with non-renewable generation projects.

The variability also means that when the resource is available (for example, the sun is shining), you want your project to export energy to the electricity grid without constraint. Therefore, for renewable energy projects, the grid connection arrangements can mean the success or failure of your project.

5 – Minimise uncertainty of revenue

The variable nature of renewable generation can create short-term uncertainty in revenue; however, long-term certainty in revenue is generally a must-have for a renewable energy project looking to sell its power output.

In some markets, set tariffs may be offered from government bodies for renewable projects. In markets with a floating electricity price, long-term power purchase agreements are often sought with counterparties such as retailers or large-scale energy consumers.

There may not be much assistance a consultant can provide on this issue – except to remind you to read the fine print of any agreements and, if the project does not have a confirmed buyer for the power, make sure you know the risks!

In terms of what the project is technically capable of generating, an operational project has more certainty than a development site, and may be more attractive for some investors.

6 – Manage capital and operational expenditure

Renewable energy projects require a large upfront capital expenditure. Depending on your risk appetite as an investor, exposure to risk can be managed through the contractual arrangements with the developer, equipment suppliers and the construction contractor. Comprehensive long-term operations and maintenance agreements are often available, which reduce your risk, but at a cost.

One issue worthy of particular note is construction delays. Investments that are otherwise sound can suffer due to delays in construction, which can have significant impacts on the expenditure and revenue profiles, and the terms of any debt provision.

7 – Develop and maintain community relationships and acceptance

Renewable energy projects operate within communities. There will be a range of attitudes towards your project and relationships to manage, and it will be up to you to develop and maintain a healthy relationship with the community.

Your community may see your project as a major contributor to the local economy through direct employment and indirectly through contracting. The community may even expect you to play a leading role in supporting local community activities through sponsorship and other activities.

8 – Ensure right action and compliance

An opportunity to invest in a renewable energy project might occur at any stage of the project. Regardless, the nature of the due diligence is usually very similar – have the right actions have been undertaken, does the project comply with its commitments, and will it continue to comply into the future?

Because Entura is part of Hydro Tasmania, Australia’s largest renewable energy producer, we understand what it means to live with the full consequences of investment decisions and risks. So we approach due diligence for our clients in the same way we would if the investment opportunity was our own.

That means developing a full understanding of the proposed project, discovering any risks that could prevent its success, and finding the best ways to make the most of the project’s strengths and avoid any possible weaknesses.

If you are seeking to invest in renewable energy, Entura can assist you with practical, expert due diligence services for proposed or operational projects in the Asia-Pacific region. Please contact Patrick Pease or Silke Schwartz on +61 407 886 872.

About the author

Seth Langford is a specialist renewable energy engineer at Entura and has been working in the wind industry for more than ten years. Seth has been involved with major wind farm projects as a technical specialist and a team leader for feasibility studies and due diligence projects in India, China, Australia, Sri Lanka, South Africa and New Zealand. Seth has spent considerable time assessing greenfield and operational wind farms on behalf of developers wishing to acquire wind farm projects.